Personal Income Tax Malaysia 2018

On the first 5 000.

Personal income tax malaysia 2018. Mulai 18 mac 2019 lembaga hasil dalam negeri malaysia lhdnm tidak lagi menerima permohonan untuk sijil taraf orang kena cukai stokc. Non resident individuals pay tax at a flat rate of 30 with effect from ya 2020. Untuk makluman stokc adalah pengesahan yang dikeluarkan oleh lhdnm ke atas status seseorang yang dikenakan cukai di malaysia. Personal income tax rates.

Self and dependent special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually. Expenses of a private or domestic. This relief is applicable for year assessment 2013 and 2015 only. Sample personal income tax calculation.

An individual whether tax resident or non resident in malaysia is taxed on any income accruing in or derived from malaysia. More on malaysia income tax 2019. Live budget 2019 malaysia updates highlights the biggest change we ve seen over the years is the increasing number of people moving from manual tax filing to e filing. Medical expenses for parents.

Malaysia individual deductions last reviewed 01 july 2020. Hopefully this guide has helped answer your main questions about filing personal income taxes in malaysia for ya 2018. Amending the income tax return form. This guide is for assessment year 2017 please visit our updated income tax guide for assessment year 2019.

Taxable income myr tax on column 1 myr tax on excess over. As the clock ticks for personal income tax deadline in malaysia 2018 like gainfully employed malaysians you may have started visiting the lhdn malaysia website to do your e filing as both a proactive and precautionary measure. Employees are allowed a deduction for any expenditure incurred wholly and exclusively in the performance of their duties but no allowance is given for tax depreciation. That is why we have made a quick guide to file your income tax 2018.

On the first 5 000 next 15 000. What is income tax. The following rates are applicable to resident individual taxpayers for ya 2020. If you have any questions about the whole process don t hesitate to ask us in the comments and we ll do our best to help you out.

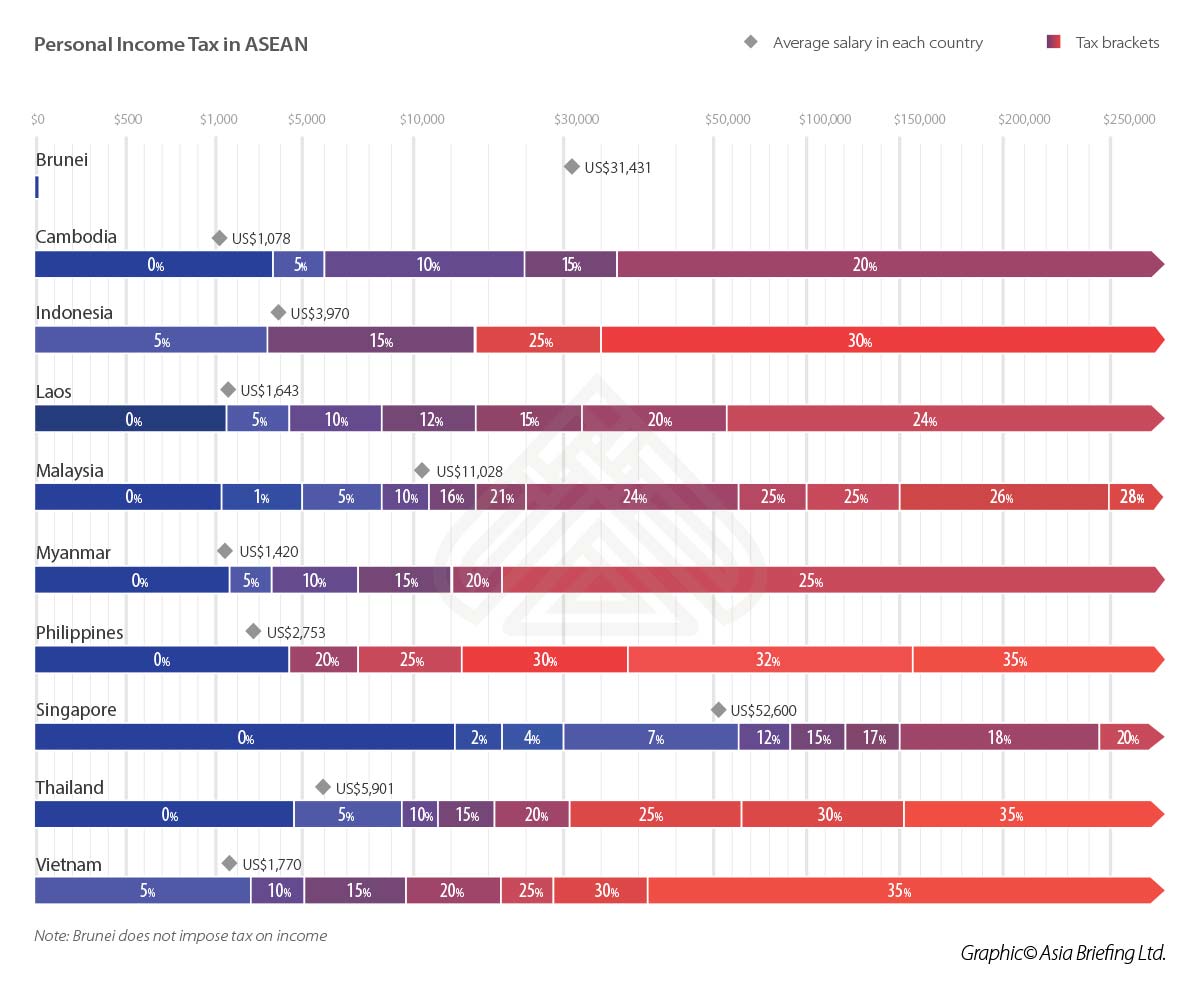

Lanjutan daripada itu pengeluaran stokc juga akan diberhentikan. Calculations rm rate tax rm 0 5 000. Income tax is a type of tax that governments impose on individuals and companies on all. Malaysia personal income tax rate a graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020.

Useful reference information for malaysia s income tax 2018 filing deadline for year of assessment 2017 for be is apr 30 2018 manual form and may 15 2018 e filing.