Real Property Gain Tax 2020

Real property gains tax exemption is now gazetted.

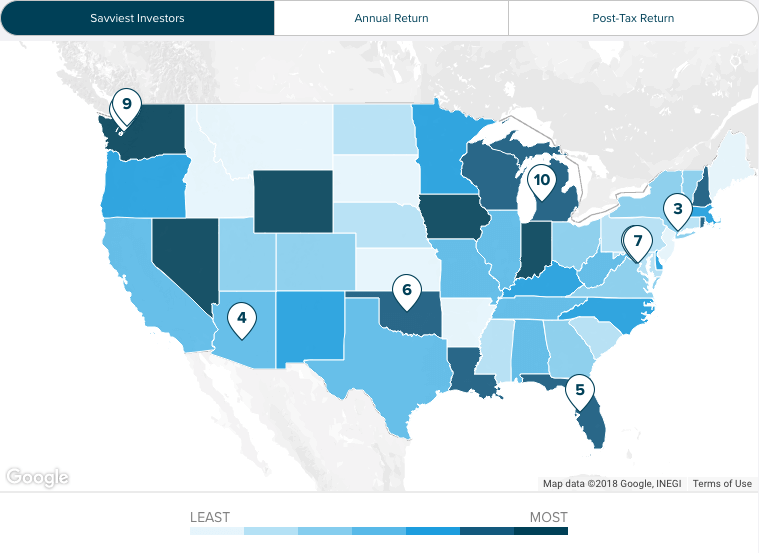

Real property gain tax 2020. On the six years onwards the real property gain tax rate is 5. Please refer to the table below for the latest real property gain tax rates. Every person whether or not resident is chargeable to rpgt on gains arising from disposal of real property including shares in a real property company rpc. Which rate your capital gains will be taxed depends on your taxable.

Whether you re a property investor or an owner just simply looking to sell your current home to purchase your dream home it s important to be aware of all costs associated with a. Related properties for sale rent at. 4 20 per 100 a vehicle has situs for taxation in the county or if it is registered to a county address with the virginia department of motor vehicles. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds.

In malaysia real property gains tax rpgt is one of the most important property related taxes and is chargeable on the profit gained from selling a property. In the 5 th year. Effective from 28 july 2020 rpgt exemption will be given to malaysians for the disposal of residential homes before dec 31 next year. The capital gains tax calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

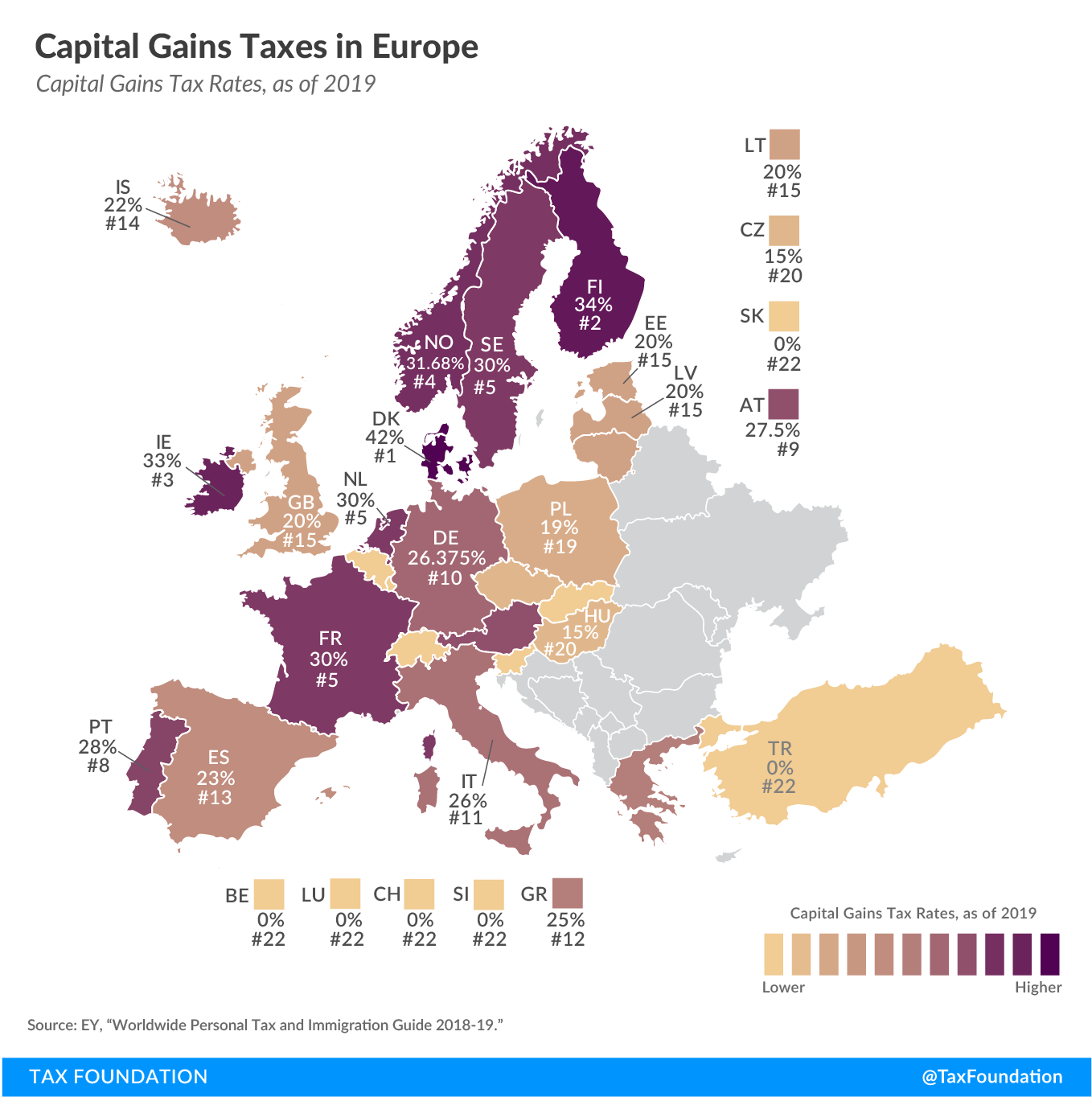

Real property is defined as any land situated in malaysia and any interest option or other right in or over such land. Includes short and long term 2019 federal and state capital gains tax rates. Effective 1st january 2020 this is the real property gain tax rpgt rate 2020. The three long term capital gains tax rates of 2019 haven t changed in 2020 and remain taxed at a rate of 0 15 and 20.

Real property gains tax scope. Avoid taxes on capital gains on real estate in 2020. July 28th 2020leave a comment. The may 5 2020 personal property tax deadline has been extended to june 5 2020.

Gain on property sales held for more than one year is classified as a. And in the past this used to be 0. Personal property tax rate.

:max_bytes(150000):strip_icc()/sale-of-your-home-3193496-final-5b62092046e0fb005051ed81.png)

/what-is-the-capital-gains-tax-fdeabd19e84849e9b12ebdadc1023859.png)

/TaxPolicy.Paul.4.2.1_-_figure_1-512c20575f6b4bc6bf23ef34dee0f9c4.png)

:max_bytes(150000):strip_icc()/TaxPolicy.Paul.4.2.1_-_figure_1-512c20575f6b4bc6bf23ef34dee0f9c4.png)

/TaxPolicy.Paul.4.2.1_-_figure_1-512c20575f6b4bc6bf23ef34dee0f9c4.png)

:max_bytes(150000):strip_icc()/will-i-pay-tax-on-my-home-sale-2389003-v4-5b4cb96046e0fb0037e65b73.png)