Section 127 Income Tax Act Malaysia

Section 127 3 b for tier 1 and value added income incentives via a gazette order.

Section 127 income tax act malaysia. Section 127 3a for tier 2 3 via an approval from the ministry of finance. 3 tarikh kemaskini. This is incentives such as exemptions under the provision of paragraph 127 3 b or subsection 127 3a of ita 1976 which is claimable as per government gazette or with a minister s approval letter. Senior member 5 330 posts joined.

The tax exemption will be provided under the following sections of the income tax act 1967. Short title and commencement 2. Income wrongly exempted etc. Laws of malaysia 6 section 26c.

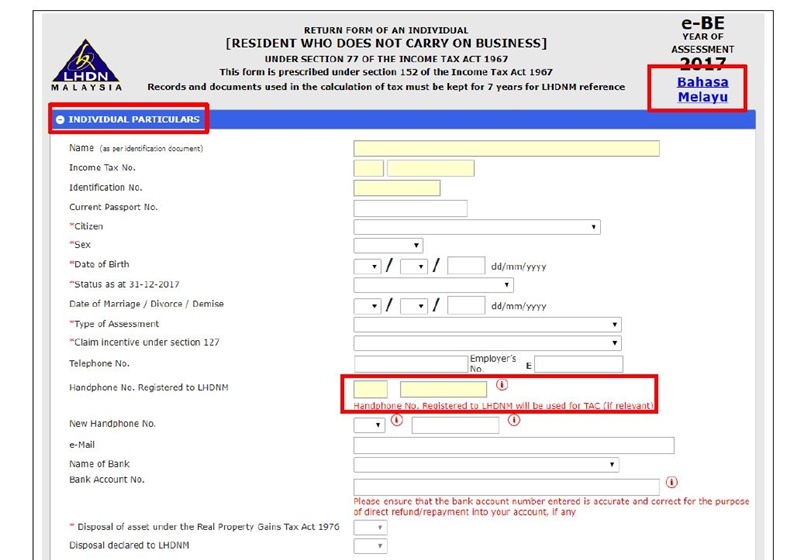

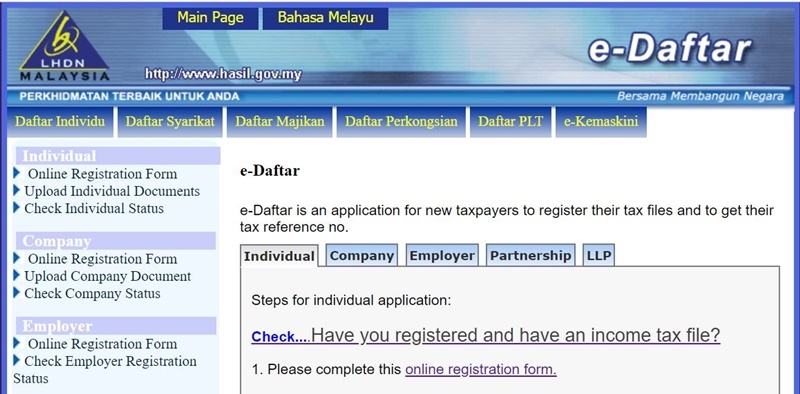

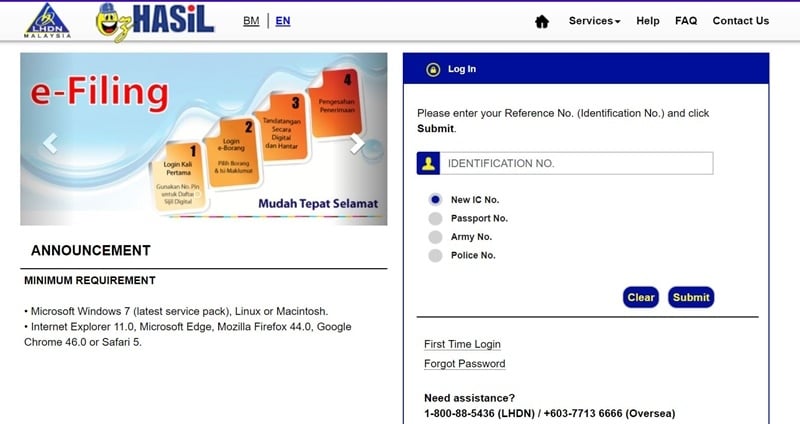

Charge of income tax 3 a. Scope of exemption granted under section 127 the clarification addresses the common interpretation issue when a non. Interpretation part ii imposition and general characteristics of the tax 3. In the same page there is an item called entitled to claim incentive under section 127 which refers to claiming incentives under section 127 of the income tax act ita 1976.

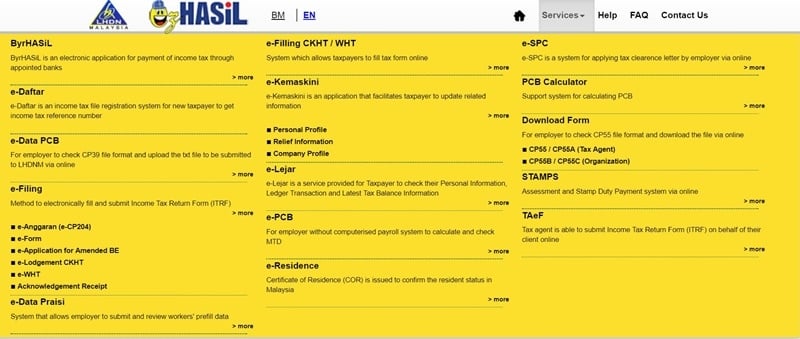

You can make any changes if the form is displaying incorrect information or does not display the latest information. Laws of malaysia act 53 income tax act 1967 arrangement of sections part i preliminary section 1. Exemptions from tax general. History subsection 127 1 is amended by act 608 of 2000 s18 by inserting after the word act the.

Section 127 of the income tax act 1967 ita is included in the mutual exclusion list of a gazette order the taxpayer therefore cannot make a claim for the incentive offered in the said gazette order. Tax exemption of statutory income for 10 years under section 127 of the income tax act 1967 act 53 dividends paid from the exempt income will be exempted from tax in the hands of its shareholders ii an approved ipc rdc status company will enjoy the following benefits. 1 notwithstanding any other provision of this act but subject to section 127a any income specified in part i of schedule 6 shall subject to this section be exempt from tax. Ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor.

Certain dividends exempted from income tax 24. Application for approval for investment tax allowance to contract. Expatriate posts based on the requirements of the ipc rdc. Laws of malaysia act 327 promotion of investments act 1986 arrangement of sections part i preliminary section.