Section 4a Income Tax Act Malaysia

Non chargeability to tax in respect of offshore business activity 3 c.

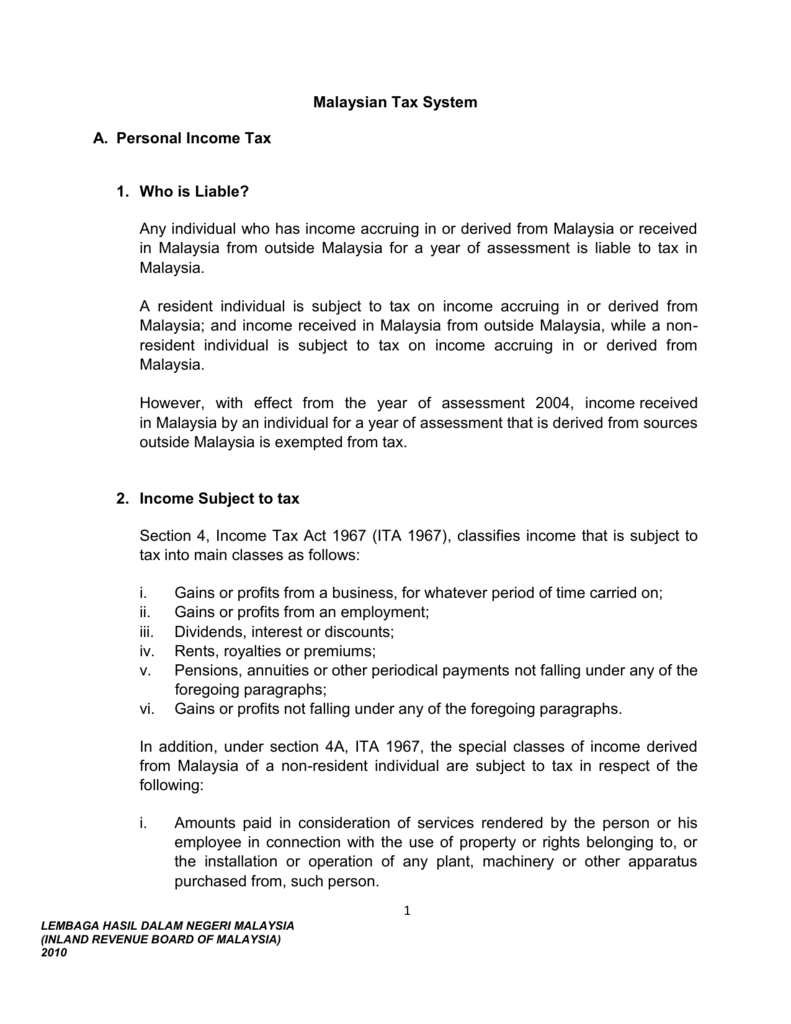

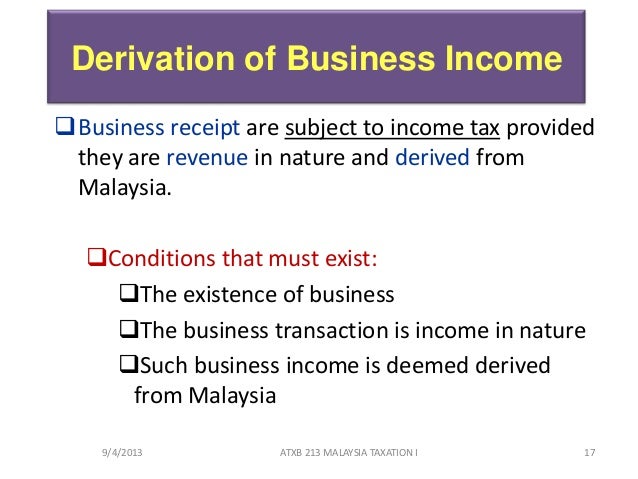

Section 4a income tax act malaysia. I amounts paid in consideration of services rendered in connection with the use of property or rights belonging to. 2 except as provided in subsection 4 a and subsection 4a the estimate of tax payable for a year of. A the responsibility for the payment lies with the government a state government or a local authority. Income under section 4 f refers to gains and profits not covered under sections 4 a to 4 e of the income tax act 1967.

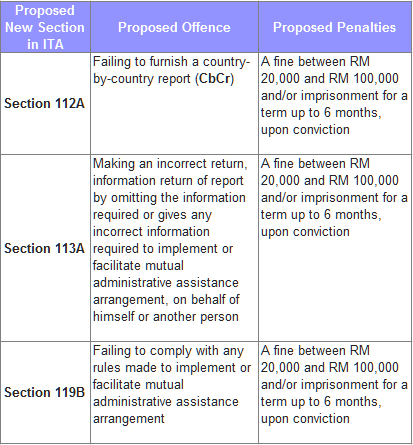

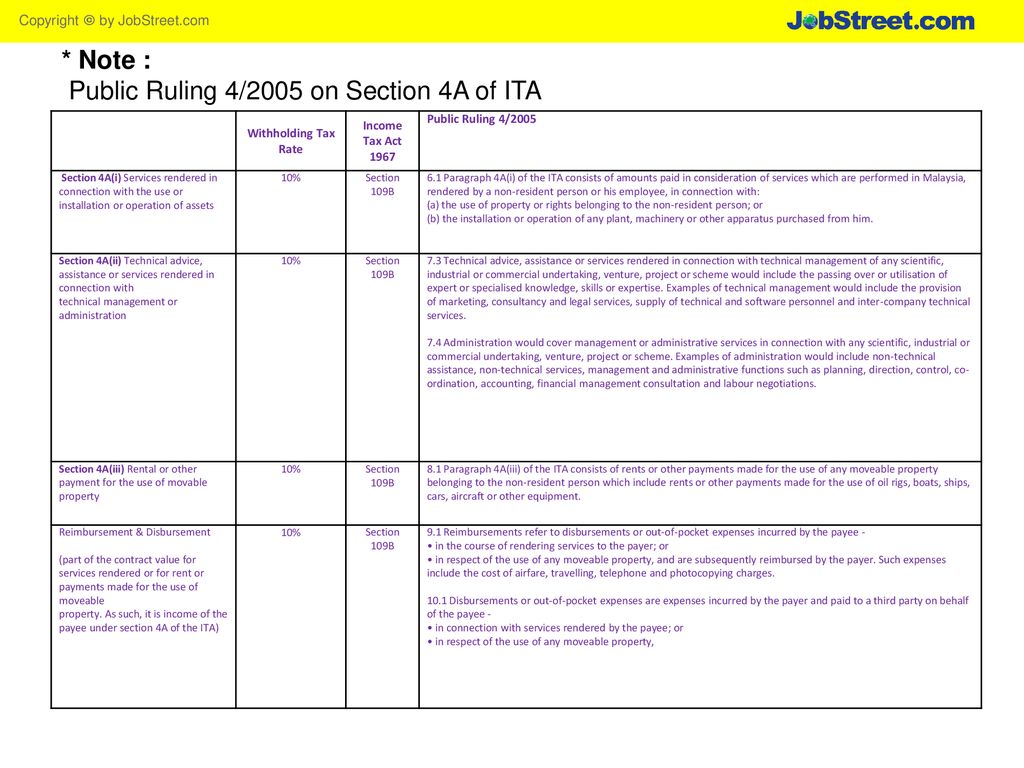

Non chargeability to tax in respect of offshore business activity 3c deleted 4. The special classes of income are those listed in section 4a of the income tax act 1967 ita. Classes of income on. 1 every company trust body or co operative society shall for each year of assessment furnish to the director general an estimate of its tax payable.

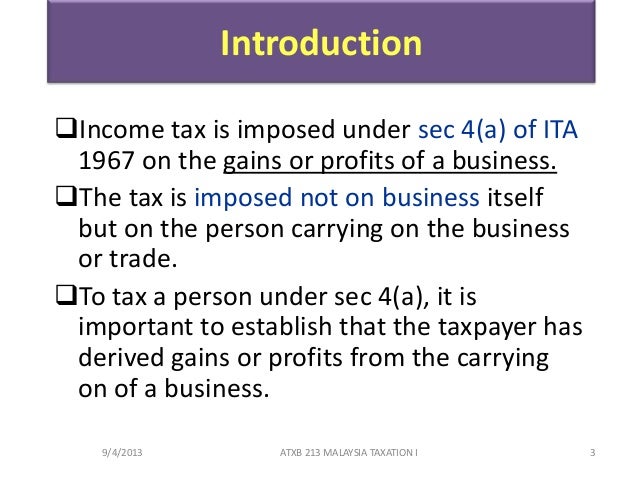

Short title and commencement 2. Charge of income tax 3 a. Section 4 income tax act 1967 in defining income 3 1 introduction 46 3 2 problems 48 3 2 1 each case needs to be decided on its own facts 49 3 2 2 needs extensive proving including calling of witnesses 47 3 2 3 no clear demarcation between revenue and capital 52. Interpretation part ii imposition and general characteristics of the tax 3.

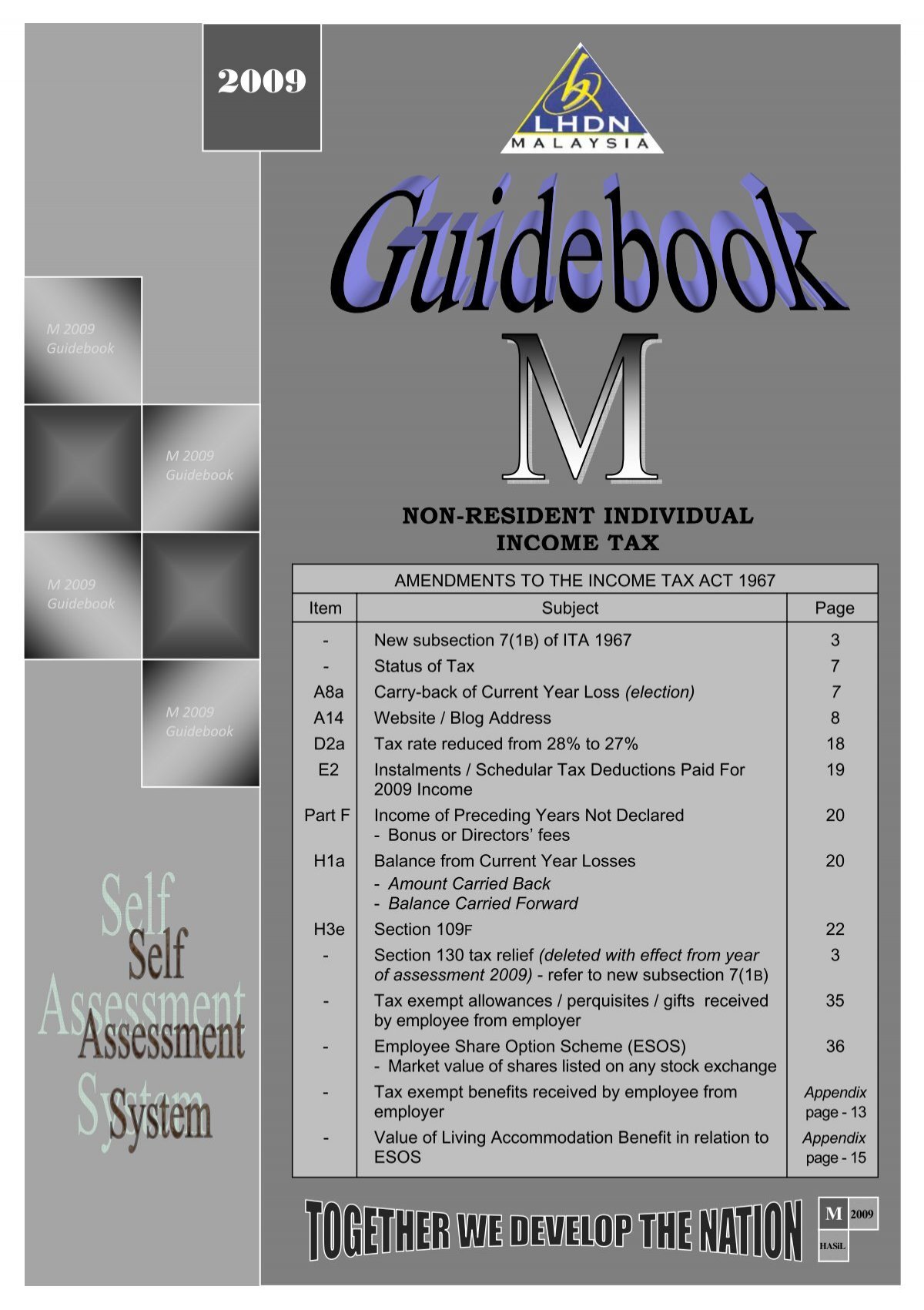

6 1 the gross income in respect of the amounts paid under paragraphs 4a i 4a ii and 4a iii of the ita 1967 shall be deemed to be derived from malaysia if. Section 4a of the income tax act 1967. October 2017 income received by non resident under section 4a i and section 4a ii of the income tax act 1967 ita will not be subject to withholding tax if the services are rendered outside malaysia. With effect from 1 january 2009 a withholding tax mechanism to collect withholding tax at 10 on other types of income of non residents under section 4 f of the income tax act 1967 has been introduced.

Laws of malaysia act 53 arrangement of sections income tax act 1967 part i preliminary section 1. Income that a nonresident derives from malaysia from special classes of income is subject to tax in malaysia. Interpretation part ii imposition and general characteristics of the tax 3. Short title and commencement 2.

5 2 pursuant to section 6 of the finance act 2017 act 785 effective from 17 1 2017 income under paragraphs 4a i and 4a ii of the ita which is derived from malaysia is chargeable to tax in malaysia regardless of whether the services are performed in or outside malaysia. Charge of income tax 3a deleted 3b. Income of a person not resident in malaysia in respect of.