Sports Development Act 1997 Income Tax

Income tax assessment act 1997 table of provisions long title chapter 1 introduction and core provisions part 1 1 preliminary division 1 preliminary 1 1 short title 1 2 commencement 1 3 differences in style not to affect meaning 1 4 application 1 7 administration of this act part 1 2 a guide to this act division 2 how to use this act subdivision 2 a how to find your way around 2 1.

Sports development act 1997 income tax. Please see the treasury laws amendment. 38 of 1997 as amended taking into account amendments up to safety rehabilitation and compensation legislation amendment defence force act 2017. This means equipment like footballs shuttlecocks nets rackets martial arts weapons fencing swords electronic scoreboards etc. 40 of 1997 as amended taking into account amendments up to treasury laws amendment reducing pressure on housing affordability measures act 2019.

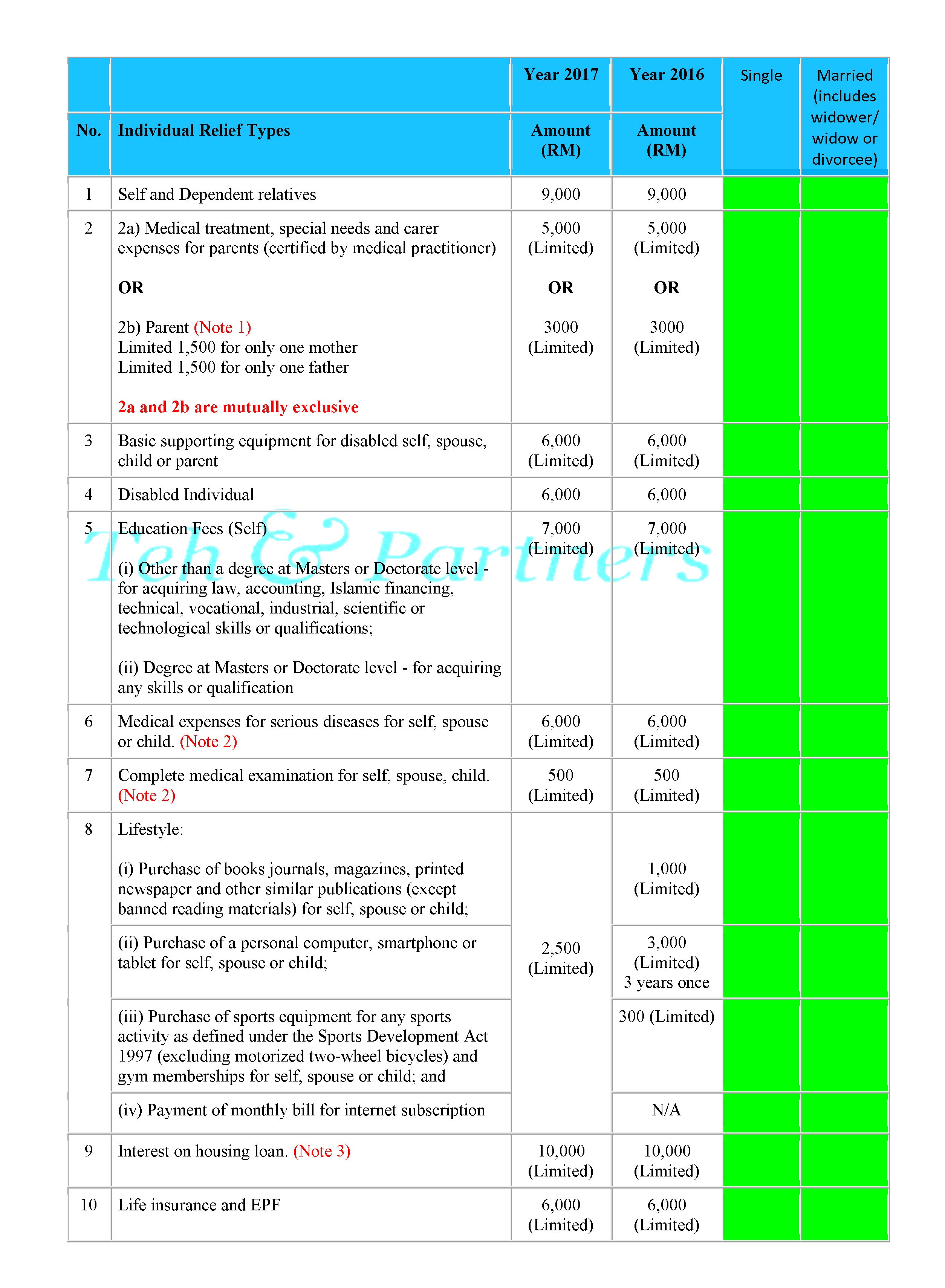

This compilation is affected by retrospective amendments. A 170 1998 01 04 1998 first schedule p u. Being proposed for national budget 2008 which unveiled on 7 september 2007 and included in the be form 2008 as tax deductible item d8c an amount limited to a maximum of rm300 is income tax deductible in respect of expenses expended by the individual tax payer for the purchase of sports equipment for any sports activity as defined under the sports development act 1997 akta pembangunan sukan 1997. The term equipment is not defined and is thus open to discussion.

As a general guideline the irb has taken the stand that consumables such as shuttlecorks golf balls etc. A 177 2000 21 04 2000 p u. Associations etc to consult and coordinate with minister 5. Purchase of sports equipment for tax deductions.

Whereas jerseys and football boots are considered as sports attires and sports shoes therefore cannot be tax deductible. An act about income tax and related matters. Lhdn states in the income tax act that the tax relief for sports equipment is only eligible for those used in sporting activities defined in the sports development act 1997. Guidelines in relation to sports development 4.

Short title application and commencement 2. Act 576 sport development act 1997 arrangement of sections p art i preliminary section 1. From the year 2008 individual taxpayers are allowed to claim tax deduction of up to rm300 a year on purchase of equipments for sports as defined by the sports development act 1997. The following activities are regarded as sports for the purposes of this act.

Other government ministries etc to consult with minister. Act 576 sports development act 1997 list of sections amended section amending authority in force from 16 p u. Purchase of sports equipment for sports activity defined under the sports development act 1997 and payment of gym membership. Are claimable whereas those long lasting items such as sports shoes badminton rackets.

Defination of sports under sports development act 1997. Tax relief up to a maximum of rm 300 a year be given on purchase of sports equipment. Interpretation p art ii sport development 3. Special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually.