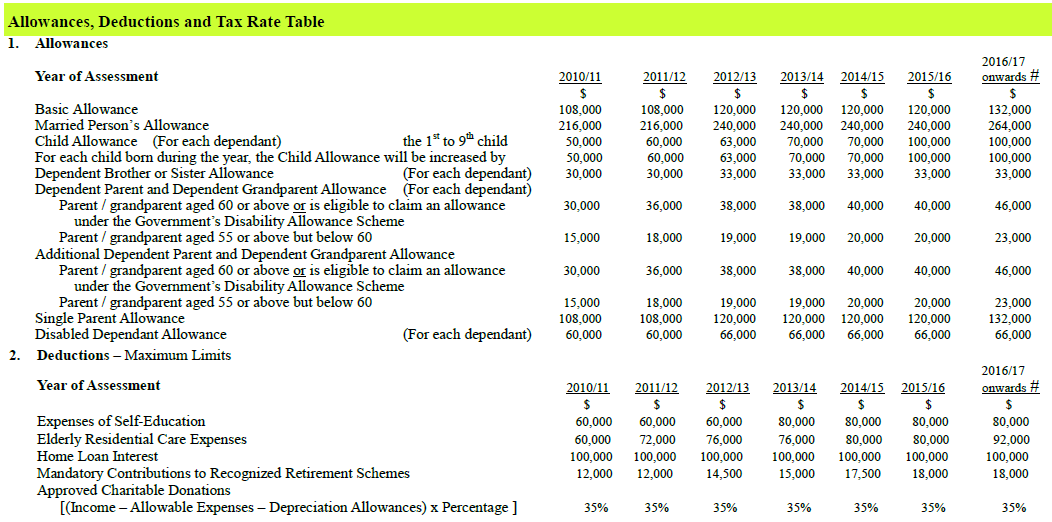

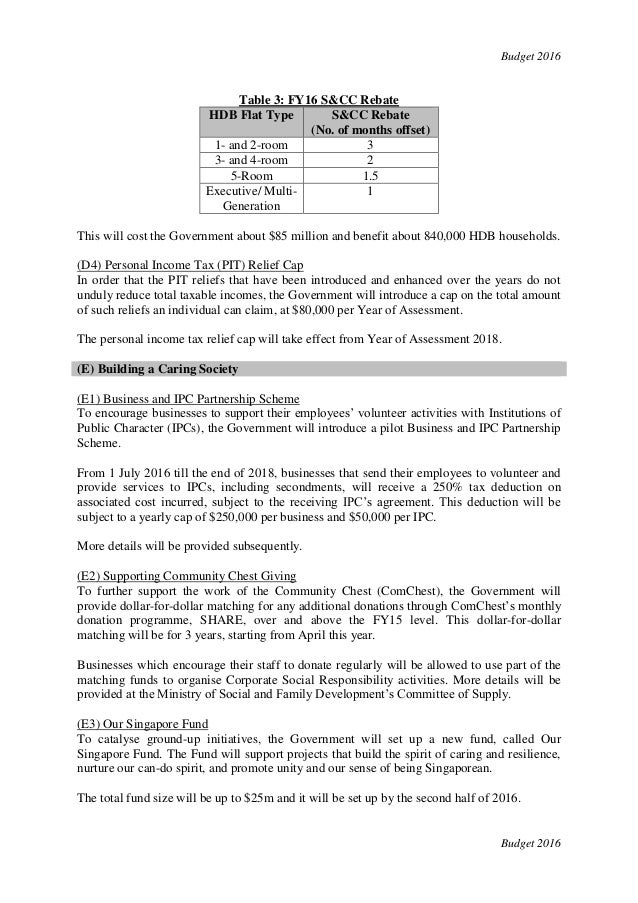

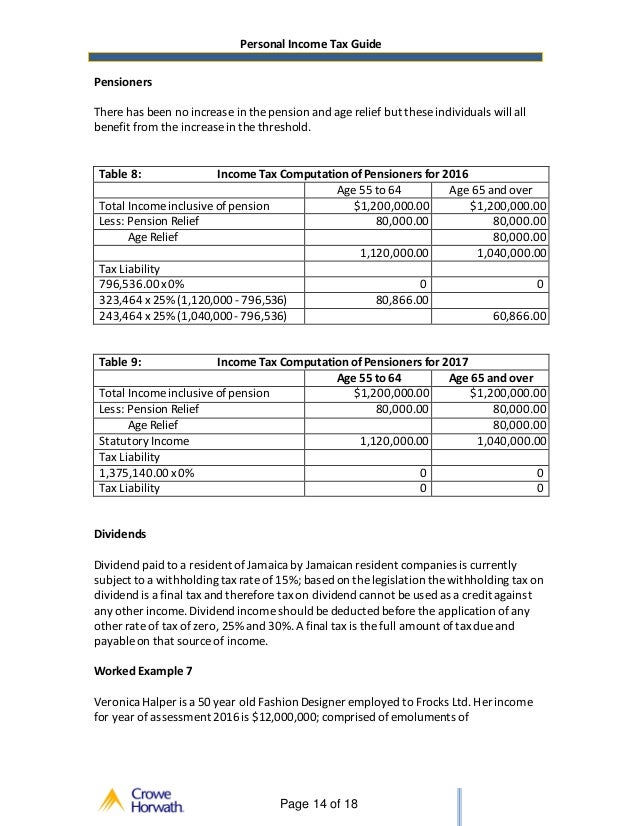

Tax Reliefs For Year Of Assessment 2016

A personal income tax relief cap of 80 000 applies to the total amount of all tax reliefs claimed for each year of assessment.

Tax reliefs for year of assessment 2016. These are for certain activities or behaviours that the government encourages or even necessities or burdens to lighten our financial loads. Tax reliefs are set by lhdn where a taxpayer is able to deduct a certain amount for money expended in that assessment year from the total annual income. Special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually. In other words the ya is the year in which your income is assessed to tax.

The assessment is for the income earned in the preceding year starting on 1 jan and ending on 31 dec. For income tax malaysia tax reliefs can help reduce your chargeable income and thus your taxes. This financial year is known as the basis period. Inland revenue board of malaysia group relief for companies public ruling no.

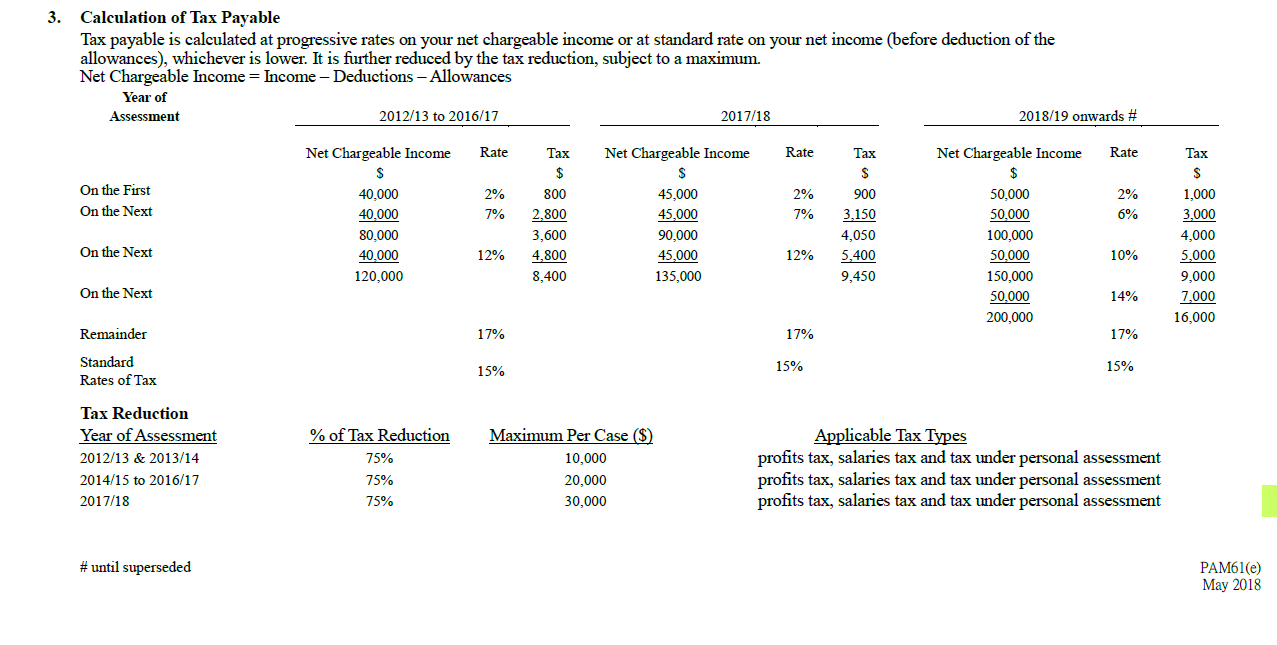

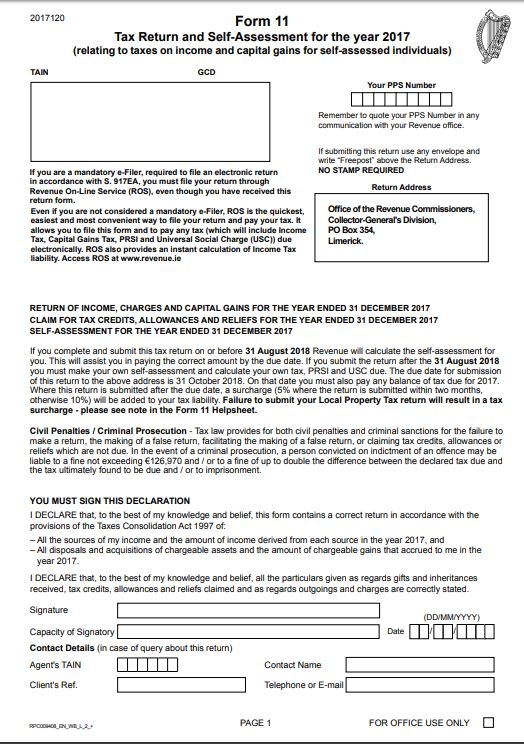

For ya 2020 the assessment is for income earned from 1 jan 2019 to 31 dec 2019. 22 august 2016 page 2 of 44 3. Year of assessment ya refers to the year in which income tax is calculated and charged. W property based incentives on which relief is claimed in 2016 16 if you are married or in a civil partnership and have opted for joint assessment in 2016 please provide your spouse s or civil partner s bank account details.

During the financial year. This will assist you in paying the correct amount by the due date. In tax terms using the same example as above 2020 is the year of assessment ya. Newly introduced tax relief for year assessment 2016 today is the fourth day that you can do your e filing for year assessment 2016.

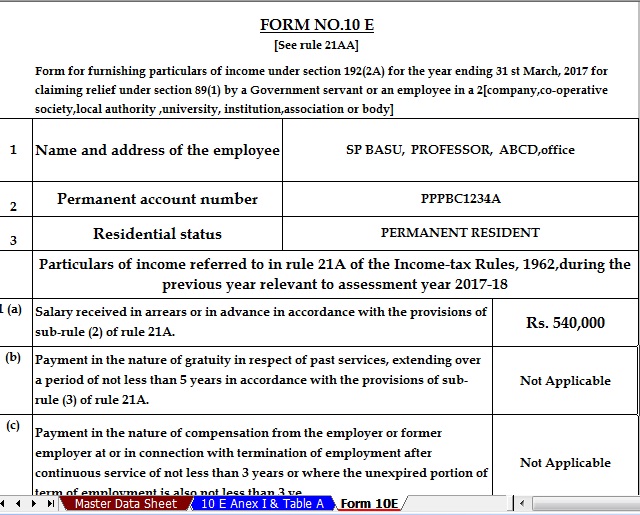

4 defined aggregate income in relation to a year of assessment means. International bank account number iban maximum 34 characters. This relief is applicable for year assessment 2013 and 2015 only. Claim for tax credits allowances and reliefs for the year ended 31 december 2016 self assessment for the year ended 31 december 2016 if you complete and submit this tax return on or before 31 august 2017 revenue will calculate the self assessment for you.

To assess the amount of tax iras looks at the income expenses etc. You should continue to claim the personal reliefs if you have met the qualifying conditions. Tax refunds will be paid to the accounts stated above.