Tenancy Agreement Stamp Duty Malaysia 2019

In summary the stamp duty is tabulated in the table below.

Tenancy agreement stamp duty malaysia 2019. 3 charge from rm500 001 to rm1 million. While paying the stamp duty there are 2 application forms which you need to submit. Exemption given on stamp duty. The tenancy agreement will only be binding after it has been stamped by the stamp office.

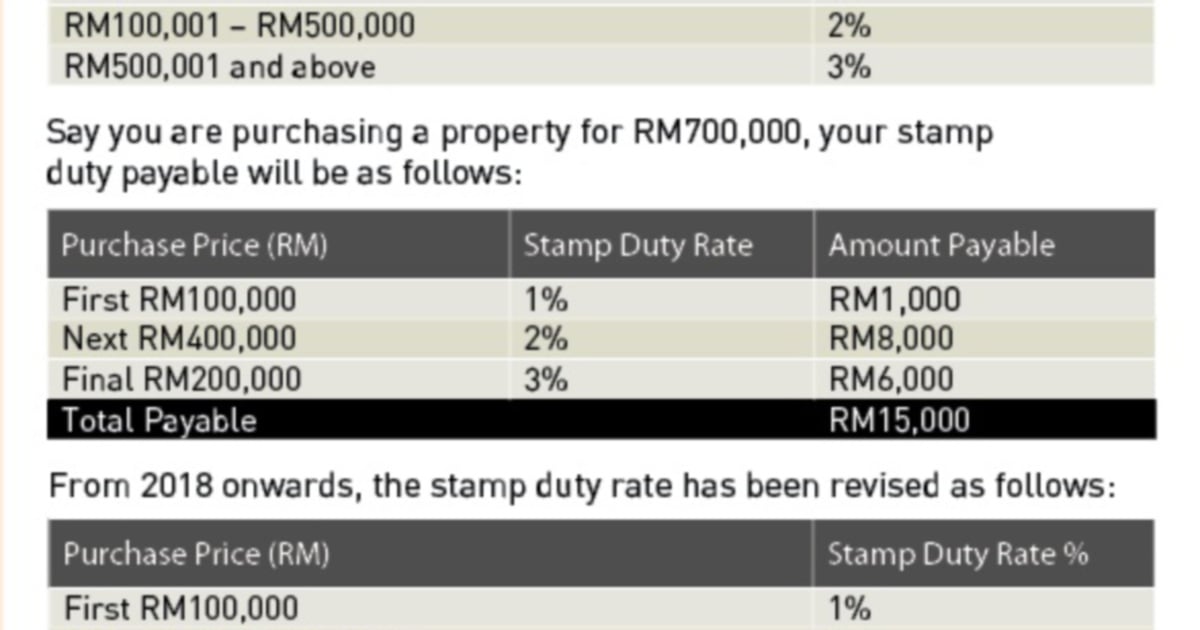

Pds 1 and pds 49 a. You will be asking to pay the stamp duty according to the rental rate table. I got the following table from the lhdn office. Stamp duty is a tax based on specific tiers with its own percentage for each level.

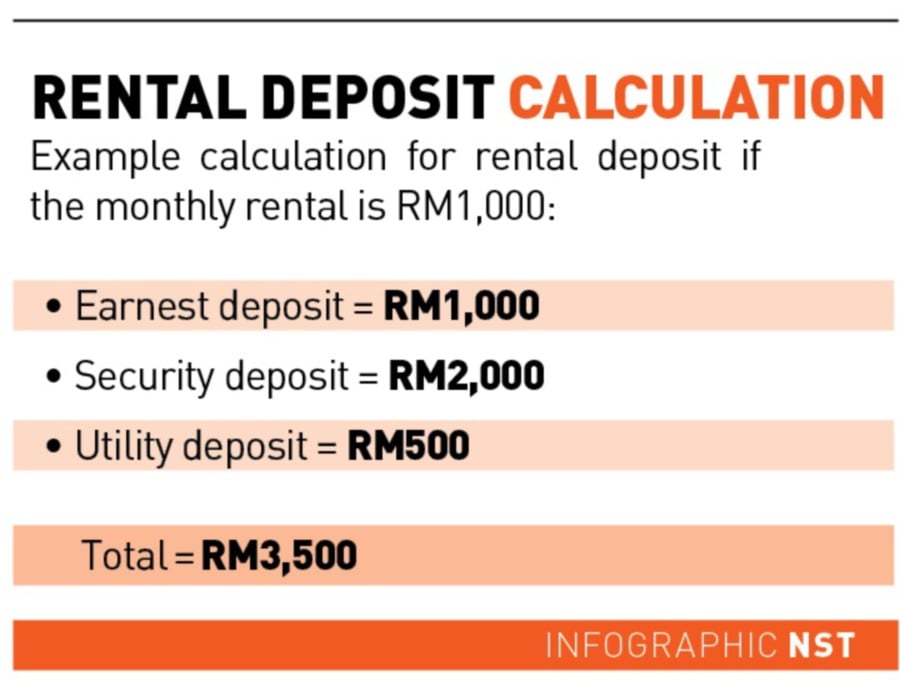

Your tenancy agreement stamp duty fee is. 100 on the first rm300 000 and excess is subject to the prevailing rate of stamp duty. Total cost involved for tenancy period of 1 year diy tenancy agreement stamp duty stamping for 2nd copy rm120 rm10 rm130. Basically the stamp duty for tenancy agreements spanning less than one year is rm1 for every rm250 of the annual rent in excess of rm2 400.

For 2 3 years agreement rm2 for every rm250 of the annual rent in excess of rm2 400. Please contact us for a detailed quotation as the following tables exclude any taxes disbursements and reimbursement charges. For contracts that are signed for anywhere between 1 to 3 years the stamp duty rate is rm2 for every rm250 of the annual rent in excess of rm2 400. The tiers are as follows with effect from 2019.

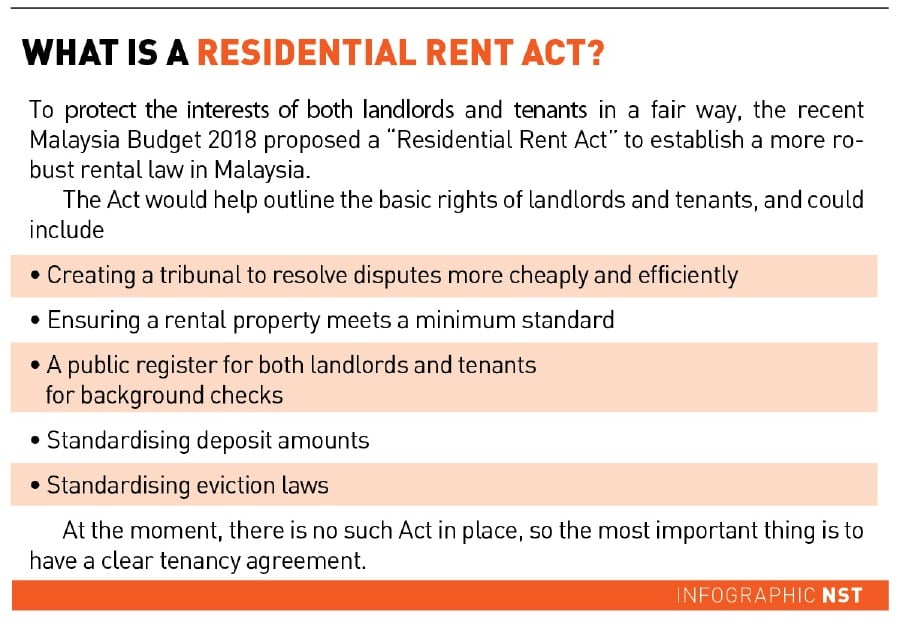

Loan agreement loan instrument ringgit malaysia loan agreements generally attract stamp duty at 0 5 however a reduced stamp duty liability of 0 1 is available for rm loan agreements or rm loan instrument without security and repayable on demand or in single bullet repayment. Either the tenant or landlord can engage a lawyer to draft the tenancy agreement. Stamp duty for tenancy agreement malaysia for lhdn usually the landlord will arrange for the stamping of the tenancy agreement. Value of instruments of transfer and loan agreement for the purchase of first home.

Faq on tenancy agreement who prepares the tenancy agreement. And period of your tenancy agreement is number of months enter value between 13 to 36 only. However for kulim branch you will need to buy the stamp hasil from pos office first before going to kulim lhdn office. Once number is called up you will have to submit the 3 forms with your 2 copies of tenancy agreement together.

Your tenancy agreement stamp duty fee is. For second copy of tenancy agreement the stamping cost is rm10. You may pay on the spot. If the monthly rental fee is rm.

4 charge for everything above rm1 million. Between rm300 001 and rm500 000. 1st july 2019 31st december 2020. Legal fee and stamp duty calculator calculation of legal fees is governed by solicitors remuneration amendment order 2017 and calculation of stamp duties is governed by stamp act 1949.

As for the tenancy agreement stamp duty the amount you have to pay is depending on yearly rental and duration of the agreement.