Real Property Gains Tax Malaysia

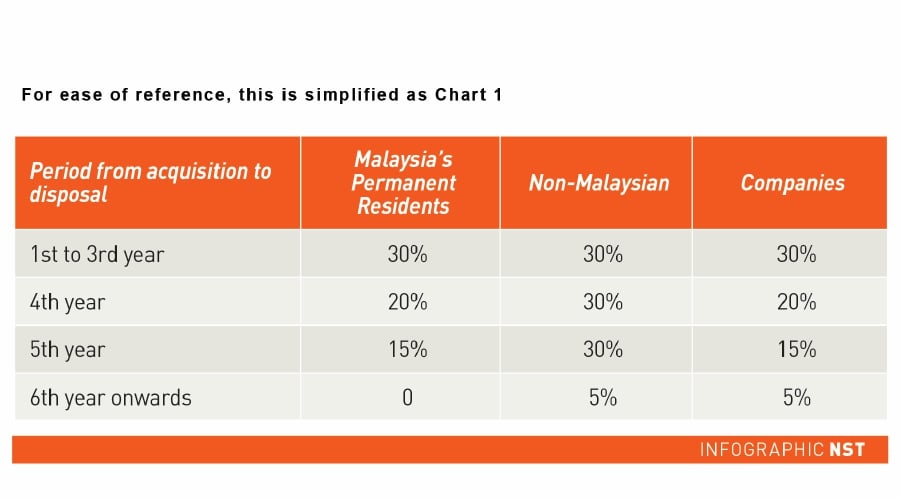

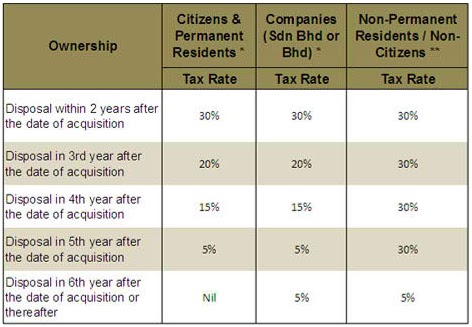

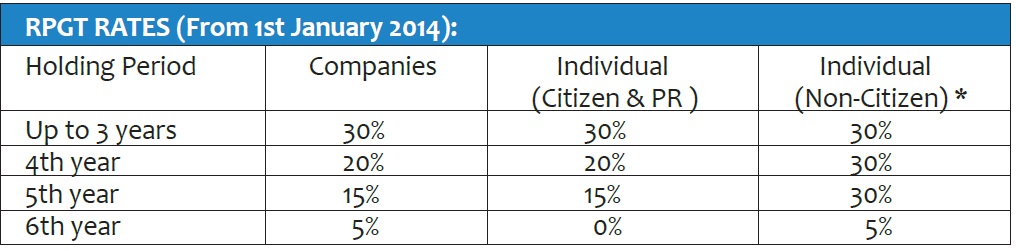

Selling a property less than or equal to 3 years of ownership results in a 30 tax on your net gains and reduces to 20 after the third year and 15 on the fourth year and finally 0 after 5 years of ownership.

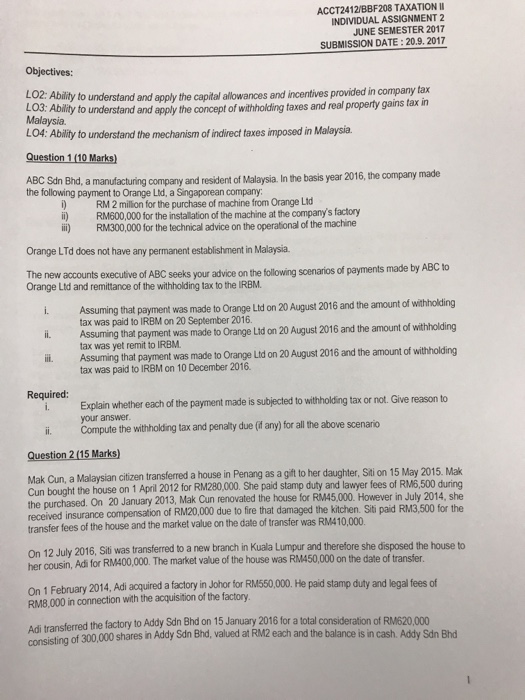

Real property gains tax malaysia. It is chargeable upon profit made from the sale of your land or real property where the resale price is higher than the purchase price. Real property gain tax or in malay is cukai keuntungan harta tanah ckht is a tax imposed on gains derived from the disposal of properties in malaysia. Real property is defined as any land situated in malaysia and any interest option or other right in or over such land. Every person whether or not resident is chargeable to rpgt on gains arising from disposal of real property including shares in a real property company rpc.

Whether you re a property investor or an owner just simply looking to sell your current home to purchase your dream home it s important to be aware of all costs associated with a real estate transaction. This however does only apply to citizens and permanent residents. For example a bought a piece of property in 2000 at a value of rm500 000. If you sell your house with a loss you don t have to pay any rpgt because you didn t make any profit.

By lim jo yan and mak ka wai rpgt is a tax chargeable on the profit gained from the disposal of a property and is payable to the inland revenue board. It is the imposition of 5 real property gain tax rpgt for gains received from disposal of properties after the fifth year of owning them. Which means that if one day you decide to sell your house you have to pay taxes on the profit gains if you have any. In simpler terms if you own a house and plan to sell it one day you will have to pay tax to the government for the gains a k a profits you re going to receive.

According to the real property gains tax act 1976 rpgt is a form of capital gains tax levied by the inland revenue lhdn. As such rpgt is only applicable to a seller. Rpgt is generally classified into 3 tiers. Rpc is essentially a controlled company where its total tangible assets consists of 75 or more in real property and or shares in another rpc.

Individuals citizens permanent residents. It is a positive move towards a higher home ownership rate among malaysians in the future. Among the measured announced there is one to me that stood out the most. A real property gains tax rpgt is the imposition of tax on your profits from selling a property.

In malaysia real property gains tax rpgt is one of the most important property related taxes and is chargeable on the profit gained from selling a property.