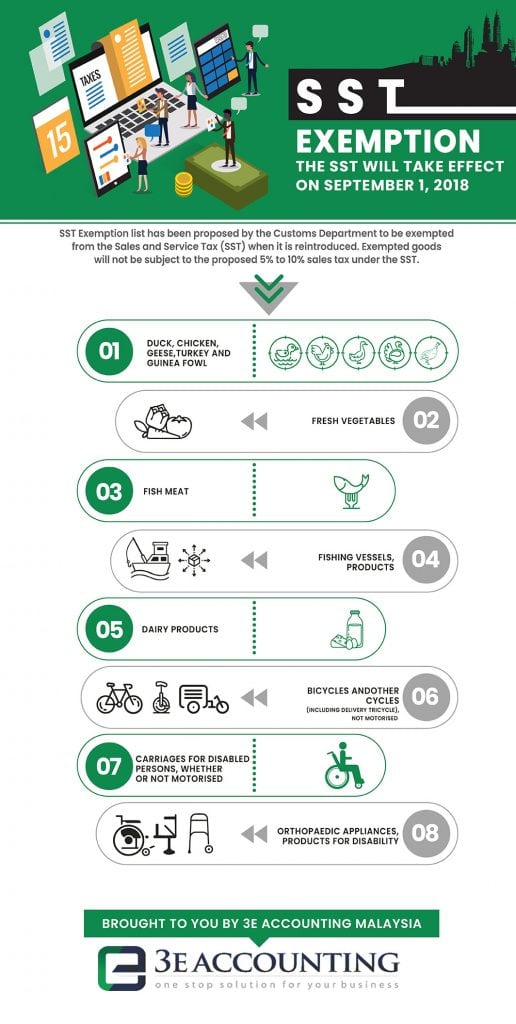

Sales Tax Exemption Malaysia

Sales tax is not charged on.

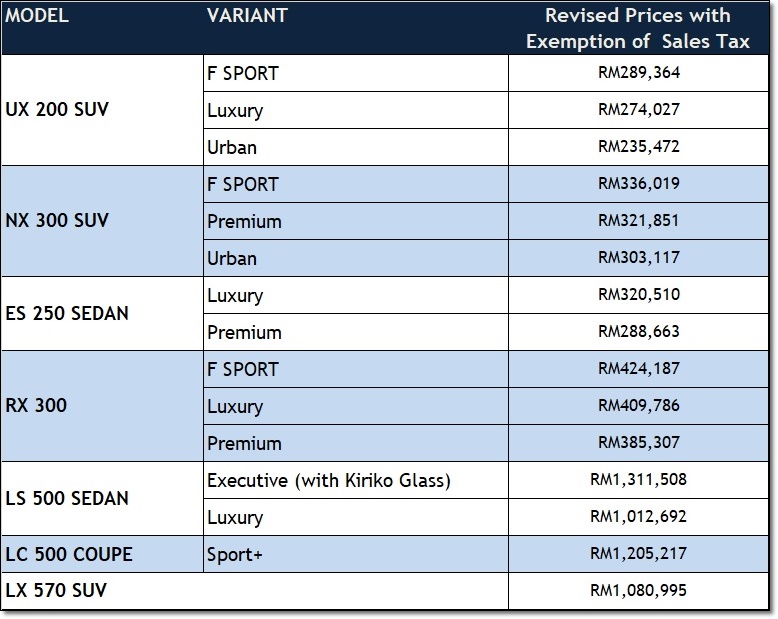

Sales tax exemption malaysia. As outlined during the announcement the incentive will see a 100 sales tax sst exemption on locally assembled ckd vehicles and 50 sales tax reduction on fully imported cbu models. Such exemption is granted in the sales tax exemption from licensing order 1972. Manufacturing activities which are exempted by minister of finance under sales tax exemption from registration order 2018. All goods are subjected to sales tax except goods exempted under sales tax goods exempted from tax order 2018 e g.

0 30 malaysian ringgits myr per litre is applicable to petroleum products. Toyota malaysia price list after sales tax exemption effective june 15th till december 31st are as follow. The current prime minister of malaysia tan sri muhyiddin yassin recently announced a host of measures to bring the country s economy back on track. As a general rule goods are subject to sales tax at a rate of 10 however some goods are taxed at the reduced rate of 5 specific rates and others are specifically exempt.

As for the hilux innova 2 0e m t taxi and the hiace prices remain unchanged as they are categorised under commercial vehicles and will not benefit from the tax exemption. Download form and document related to rmcd. The malaysian pm has announced tax exemptions to pull the country s auto sector out of the slump which includes slashing sales tax by up to 100 per cent on certain vehicles temporarily. Live animals unprocessed food vegetables medicines machinery chemicals.

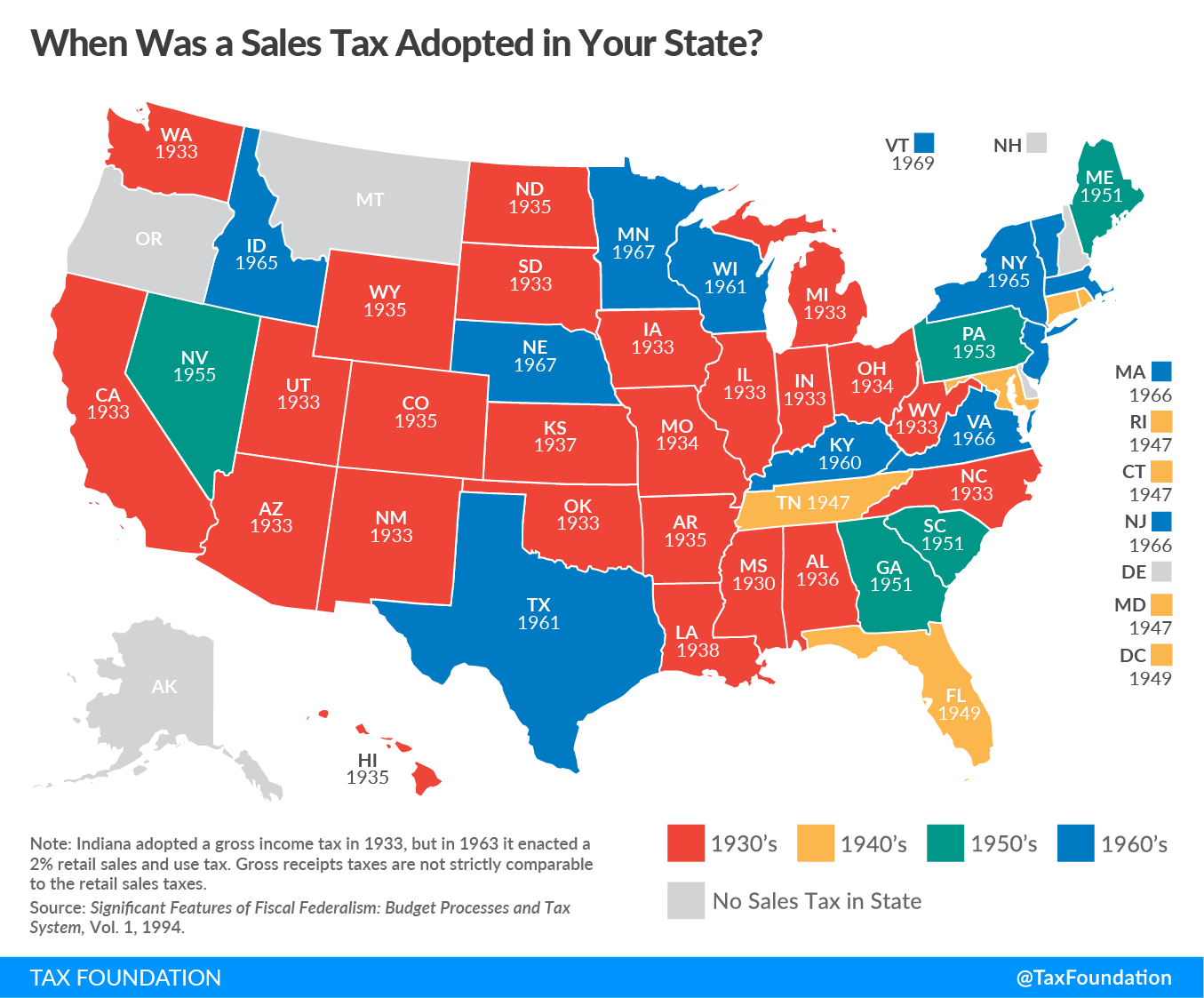

Sales tax is charged by registered manufacturers of taxable goods and on the importation of taxable goods into malaysia. Sales tax was reinstated on 1 september 2018 as malaysia moved away from the former gst regime. The schedule a of the sales tax exemption from licensing order 1972 stipulates that manufacturers with an annual sales turnover of taxable goods not exceeding rm100 000 are exempted from the requirement of applying for a sales tax licence. There are exemptions from sales tax for certain persons e g.

Persons exempted under sales tax persons exempted from payment of tax order 2018 goods listed under sales tax goods exempted from tax order 2018. Well yes but not by as huge of a margin as you might expect. Registered manufacturers who acquire or import raw materials to be used in the manufacturing of taxable goods. This is because the exemption applies only to the vehicle s sales tax which is 10 for both ckd and cbu passenger vehicles and.

_0.png)